Beyond the name...Serious enterprise software.

A look at Datadog's recent earnings.

“I have setup a Datadog alert for you” mentioned a DevOps engineer at an ad tech company I was working for many years ago.

“What’s that ?” I asked.

“Oh, it sends a text to your phone if something goes wrong in the system hosting our product” said the engineer, looking at me with an expression that said “You really should know this”.

I remember thinking to myself “What kind of a name is Datadog for something as serious as a piece of software that monitors your systems?”

And then I forgot all about it till recently Datadog (DDOG) popped up on my radar as a recent public company with a, wait for it….$23.61Bn market cap. WOW!

Anyways, I digress: Let’s get back to the task at hand which is some quick thoughts on DDOG’s recent earnings call:

Just like with Pagerduty and Snowflake’s recent earnings calls, the tone of the call was congratulatory.

They are not merely a monitoring company but more of an observability platform. The difference between the two while subtle is key, as observability is much bigger than monitoring, hence likely a much bigger market. This is brilliantly explained in this post on thenewstack.io.

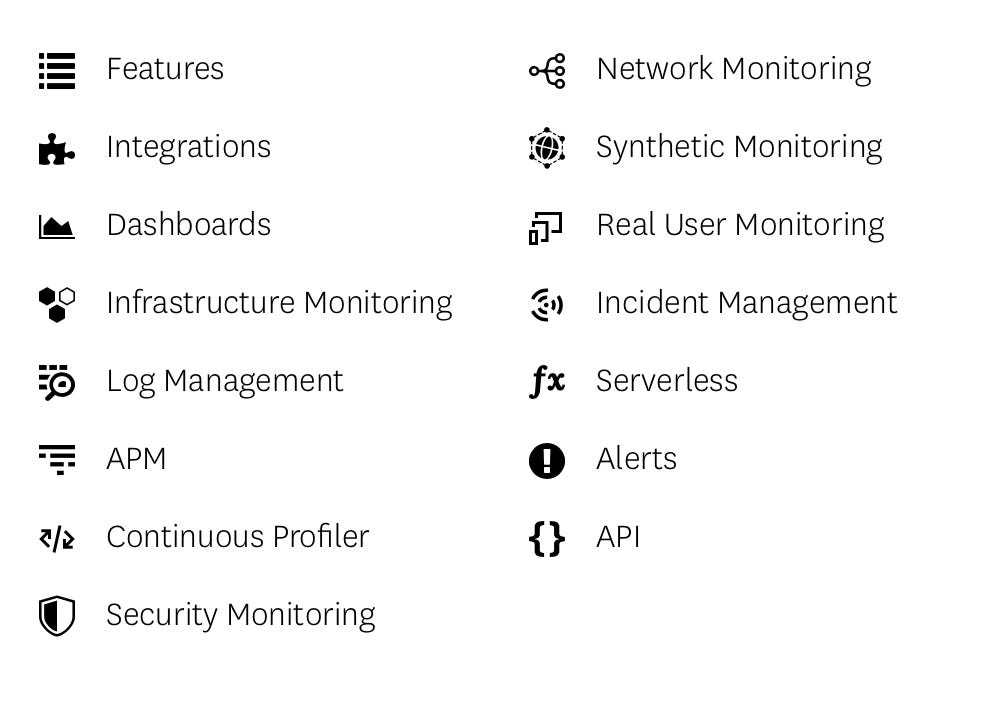

They have a wide range of products in this area. See below:

They recently branched into offerings in the Security space via a security monitoring product.

They also recently made their Incident Management product generally available.

Overall the velocity of new product releases seems to be very high.

They have usage based pricing (which is great) and customers tend to start small, but from my experience at Pagerduty, once these products are integrated into the systems and applications, it’s often hard to rip them out.

Their NRR is holding steady at > 130%. As a reminder, NRR > 100% means that a company is deriving more revenue from it’s existing customers.

Also as the economy improves and their customers’ businesses grow, usage is likely to accelerate. This should be a tailwind.

They made 2 acquisitions in the quarter: Sqreen, a SaaS based security platform, and Timber Technologies, the maker of an observability data management product.

Similar to Snowflake, their CEO (Olivier Pomel) was straightforward and seemed to know the space really well.

Takeaway

I get that DDOG is an expensive stock but with an ~ 34% pull back from it’s recent highs, coupled with their execution in a massive digital transformation market, it’s worth a deeper look.

Next

I’ll leave you with this for now. Please be sure to subscribe to get the latest straight to your inbox:

In the meantime, tell your friends:

________________

• The contents of this blog are the personal opinions (not reflective of my employer’s views) and investment choices of the writer (i.e. me). Please don't treat them as investment recommendations.

• I have long positions in DDOG, PD and SNOW. Additionally I worked for Pagerduty from Aug 2016 - Feb 2018.